strategic real estate investments.

strategic real estate investments.

strategic real estate investments.

strategic real estate investments.

About Us

Investment Philosophy

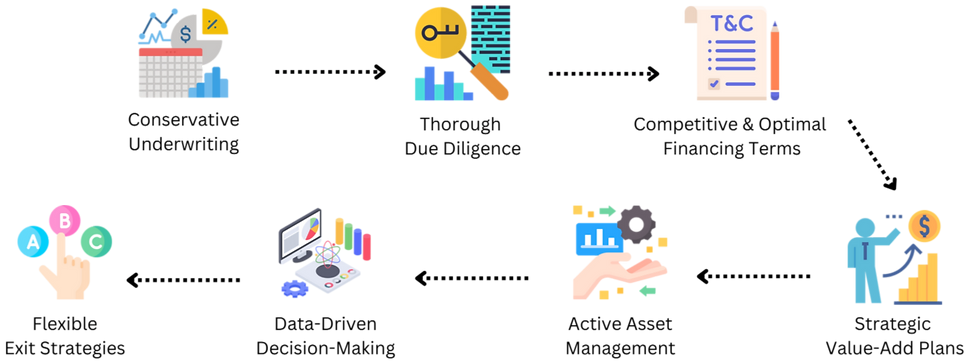

The 7 Pillars of Our Investment Strategy

The 7 Pillars of Our Investment Strategy

Conservative Underwriting

Conservative underwriting is a risk management strategy employed by financial institutions to mitigate potential losses and ensure long-term stability.

Thorough Due Diligence

Thorough due diligence is a meticulous and comprehensive process undertaken to evaluate and verify critical information before making significant decisions or transactions.

Competitive & Optimal Financing Terms

Competitive and optimal financing terms are designed to ensure that a borrower secures the most favorable financial conditions available in the market, tailored to their specific needs and financial situation.

Strategic Value-add plans

Strategic value-add plans are deliberate and comprehensive strategies designed to enhance the value of an asset, business, or project beyond its baseline performance.

Active Asset Management

Active asset management is a dynamic and hands-on approach to managing investments or assets with the goal of achieving superior returns and optimizing performance through continuous oversight and strategic decision-making.

Data-Driven Decision-Making

Data-driven decision-making is a systematic approach to making business decisions based on the analysis and interpretation of data.

Flexible Exit Strategies

Flexible exit strategies are adaptable plans designed to facilitate the smooth withdrawal or divestment from an investment, business, or project.

The 7 Pillars of Our Investment Strategy

Conservative Underwriting

Thorough Due Diligence

Competitive & Optimal Financing Terms

Strategic Value-add plans

Active Asset Management

Data-Driven Decision-Making

Flexible Exit Strategies

The 7 Pillars of Our Investment Strategy

01

Step One

Conservative Underwriting

Step Two

Thorough Due Diligence

02

03

Step Three

Competitive & Optimal Financing Terms

Step Four

Strategic Value-add plans

04

05

Step Five

Active Asset Management

Step Six

Data-Driven Decision-Making

06

07

Step Seven

Flexible Exit Strategies

Testomonials

Since most investors purchase with all cash, you can sell your property as soon as your two parties agree on the conditions of sale. The average time it takes sellers to close with an all-cash investor is two weeks. If you’re selling to a buyer who needs a mortgage, it’ll take you 60 days’ minimum.

sold.com

Quite often investors are willing to pay cash for a home and with the recent tightening of financial restrictions, coupled with the growing number of complaints about low appraisals, having a cash buyer has become even more appealing.

Forbes.com

A key benefit of selling your house to a real estate investor is that you save on commission. You don’t need to involve yourself with a real estate agent. While commissions that real estate agents charge is negotiable, most areas of the county a 5% to 6% commission to complete the transaction in your house is typical.

Realty Biz News

If you have been receiving repossession threats or foreclosure notices from your lender or bank, selling your home to an investment company can be an effective solution. A real estate investment company will buy your home in cash and as-is, giving you enough funds to move out and rent a house elsewhere. Some investment companies will even take over the mortgage payment and allow you to rent the house from them if you want to keep living in a familiar environment.

Home World Design

News/Blog

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever …

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever …

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever …

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever …